Welcome to July’s edition of money while you sleep. We added to a couple positions and dropped one this month. I’ll get to that shorty. We had a very busy but fun July doing many different things. Here is what we have been up to as the dividends continue to come in.

- We celebrated our 10 year anniversary with a short trip to Canmore.

- My wife and I played Silver Tip.

- My sister got Married!

- Saw my best man for the first time in years.

- C finished up Baseball.

- Had a beach day at Allan Beach.

- Took in a spray park day with the kids.

Portfolio details:

This month our portfolio was down month over month but who cares if you have a long term perspective. We continue to get the portfolio in a position that we don’t need to look at it each day and just continue to watch the dividends roll in. We bought into one new company, added to another and sold one. The TSX slightly rose from 20165 on July 1 to 20287 on July 30.

Quick trades:

No quick trades in the month.

Please note: I only do this with companies I’m comfortable holding for a long period of time.

Sold:

We sold 111 shares of RUS.TO @ $33.03

Russel Metals has been on a roll as of late. We had bought them in May of 2019 by purchasing 100 shares @ $23.77. The total return over the two years including dividends is 54%, 27% annually. Although its had a good run I’m not sure it can continue for to long with the economy opening up and metal prices likely to come down. The chart below speaks for itself. We have allocated the funds to another position that has shown impressive dividend growth over the past 10 years or so and we believe will have a more consistent return over the next several years. Still nice to lock in those profits, just think if we sold 8 months ago our return would of only been what the dividends were paying us. Food for thought.

Bought:

Added to our MFC.TO position by purchasing 175 more shares at $23.47

Who is MFC:

Manulife Financial Corporation, together with its subsidiaries, provides financial products and services in Asia, Canada, the United States, and internationally. The company operates through Wealth and Asset Management Businesses; Insurance and Annuity Products; And Corporate and Other segments. The Wealth and Asset Management Businesses segment provides mutual funds and exchange-traded funds, group retirement and savings products, and institutional asset management services through agents and brokers affiliated with the company, securities brokerage firms, and financial advisors pension plan consultants and banks. The Insurance and Annuity Products segment offers deposit and credit products; individual life, and individual and group long-term care insurance; and guaranteed and partially guaranteed annuity products through insurance agents, brokers, banks, financial planners, and direct marketing. The Corporate and Other segment is involved in property and casualty insurance and reinsurance businesses; and run-off reinsurance operations, including variable annuities, and accident and health. It also manages timberland and agricultural portfolios; and engages in insurance agency, portfolio and mutual fund management, mutual fund dealer, life and financial reinsurance, and fund management businesses. Additionally, the company holds and manages oil and gas properties; holds oil and gas royalties, and foreign bonds and equities; and provides investment management, counseling, advisory, and dealer services. Manulife Financial Corporation was incorporated in 1887 and is headquartered in Toronto, Canada.

Our why:

We started buying Manulife shares back in 2016. Manulife gives you some diversification as they operate in multiple countries. Our biggest reason is the potential for additional growth in China. They have such a huge market and Manulife continues to perform well their. Manulife continues to beat analysts expectations, this has been going on for quite sometime. They are trading at a PE ratio under 7, have a payout ratio of 31% leaving plenty of room for them to continue to raise the dividend once restrictions are lifted. We also see interest rates going up sooner than expected with the amount of visual inflation going on which is a very good thing for an insurance company. Manulife may be the best value play in the sector. This addition gives us a total share count of 368 shares, allows us to drip 4 new shares each quarter and brings in $412.16 annually.

Bought:

Opened a new position in GRN.TO position by purchasing 15oo shares at $1.22

Who is GRN:

Greenlane Renewables Inc. designs, develops, sells, and services a range of biogas upgrading systems worldwide. The company’s systems remove impurities and separate carbon dioxide from biomethane in the raw biogas created from anaerobic decomposition of organic waste at landfills, wastewater treatment plants, and farms and for injection food waste facilities into the natural gas grid or for direct use as vehicle fuel. It offers water wash, pressure swing adsorption, and membrane separation technologies. The company markets and sells its upgrading systems under the Greenlane Biogas brand. The company was formerly known as Creation Capital Corp. and changed its name to Greenlane Renewables Inc. in June 2019. Greenlane Renewables Inc. was founded in 1986 and is headquartered in Burnaby, Canada.

Our why:

As we continue to see the economy go toward renewables GRN provides options for various plants, farms, landfills facilities etc…. Greenlane continues to sign new deals all over the world. They have a market cap of 240 Million, 70 Million is assets with 36.5 million in cash and zero debt. Revenue has been climbing at an impressive clip. In the first 6 months of 2021 revenue is just shy of 25 million vs 7 million in the same timeframe in 2020. I see this continuing over the next several years. We will keep an eye on the financials for the remainder of the year and may add again in the near future.

Dividend increases and decreases

- No increases or decreases this month!

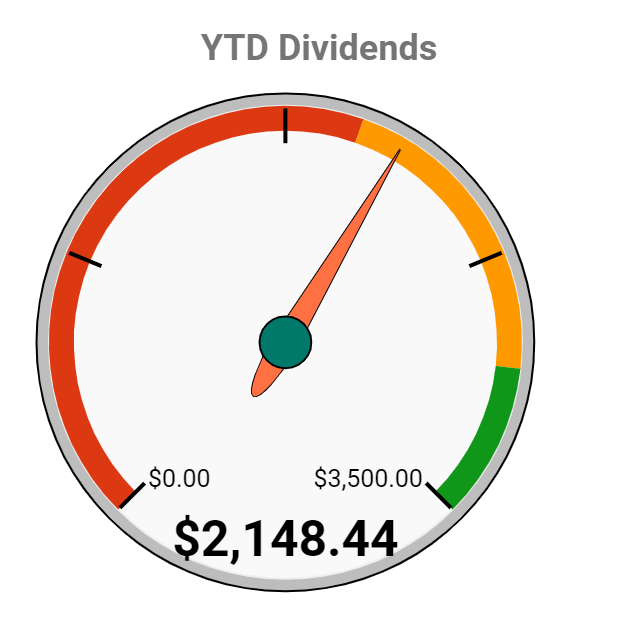

2016 – 2021 Dividends received

July is the highest amount of dividends we have ever received and the first time hitting over $400 by receiving $412.47. That is YOY growth of 46%. This keeps us on track to beating our 2021 goal of receiving at least $3,400 in dividends. If nothing changes we would beat our goal by 7%.

Dividends received

| Stock List | Dividend | Drip | Account |

| FRU.TO | $4.68 | No | TFSA 1 |

| EXE.TO | $7.44 | No | TFSA 1 |

| CSH.UN | $16.27 | Yes, 1 share | TFSA 1 |

| ALA.TO | $5.58 | No | TFSA 1 |

| PLZ.UN | $10.36 | Yes, 2 shares | TFSA 1 |

| NPI.TO | $14.10 | No | TFSA 1 |

| SIS.TO | $5.40 | No | TFSA 1 |

| EIF.TO | $6.84 | No | TFSA 1 |

| CNQ.TO | $37.60 | No | TFSA 2 |

| CM.TO | $61.32 | No | TFSA 2 |

| AQN.TO | $61.05 | Yes, 3 shares | RESP |

| KL.TO | $23.15 | No | TFSA 1+2 |

| ATD-B.TO | $7.00 | No | TFSA 1 |

| TD.TO | $79.79 | No | RESP |

| POW.TO | $65.34 | Yes | TFSA 1 |

| Rebates | $4.95 | N/A | |

| Total: | $412.47 | |

Current economy conditions

Canada unemployment rates % have now started to fall which seems obvious due to Canada starting to open for business. As you can see from the chart below we hit unemployment of 7.5% in July which is down slightly from 7.8% in June. Government funding from Covid should stop mostly by the 4th quarter.

Gold Prices

Gold is hanging on around $1,800 USD. I know that Governments have come out and said that inflation is not an issue however anyone who is making their daily purchases may disagree with this, including me. I see Gold outperforming in the second half of the year. I’d expect we will see similar patterns in other precious metals.

Market

The next little while is going to be interesting. It remains to be seen if any Covid variants will have any major impact on us. Until we fully understand where the end is its probably best to stick with the consistent blue chip names before dipping your feet into riskier areas although it may create better valuations.

Sectors I’m currently looking at

- Communications

- Technology

- Utilities

- Basic metals

- Renewables

Current watch list

- Quebecor Inc.

- Greenlane Renewables Inc.

- Enbridge

- Algonquin Power and Utilities Corp

- Brookfield Renewable Partners L.P.

Thanks for reading and feel free to leave a comment!

Invest in yourself

Brian

Disclosure: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. Please ensure you do your own research.